Note: This article was filed by a paid contributor to Xerox Corporation.

Tax season is officially upon us, and you know what that means. It is time to get up close and personal with your business’s finances and try not to stress out too much over it.

Psychologist Michael McKee accurately summed up this tax season-induced stress for WebMD: “Money is a major source of stress for people, and what tax season does is shine a great big spotlight on the issue. Money takes center stage at tax time, even if you might have been able to push it to the wings the rest of the year.”

As a small business owner, it is understandable that you would be feeling a lot of pressure right now. You have got to get all your financials in order from the previous year, issue the necessary tax documents to your employees and contractors, all while continuing to run and build your business.

Want a little help in preparing your 2016 tax returns? Follow these steps to keep everything organized, on track, and error-free.

-

Know the filing deadline.

Filing deadlines can change from year to year, so it is important to stay abreast of this information, so you file on time. This year, S-corporations and partnerships have until March 15 to file while C-corporations have until April 15.

-

Create a tax prep checklist.

If you do not already have an easy way to track your income and expenses from 2016, create a tax preparation checklist to ensure you capture everything. H&R Block offers one for free, so this is a good place to start.

-

Sign up for bookkeeping software that works with Web Capture Service.

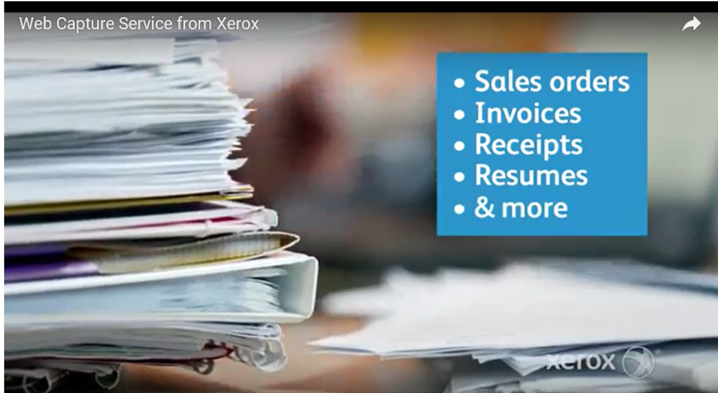

Automation is always a good thing for the small business owner, especially if it means less time spent on a task you are not trained in or comfortable with. FreshBooks and QuickBooks are two of the most popular and affordable options for small business owners. Also, QuickBooks integrates with TurboTax to make filing taxes even easier. Couple bookkeeping software with Xerox Web Capture to capture and manage paper receipts and automate their entry to save even more time.

-

Get a multifunction printer.

If you do not already have one, get one now. Being able to scan and print documents on demand (and securely) will be a significant time saver during tax season. Now through March 31, 2017, Xerox is offering a number of rebate offers on printers perfect for small business including the Phaser 6510 and 6600.

-

Collect your records all in one place.

If your business is brand new, you may not have had the foresight to open a credit card and banking account solely for business purposes this year (which is okay). Regardless of where your financial transactions take place, you need an effective way to gather that information before filing your taxes. Bookkeeping software will help with the organization piece of this. Now you will need to collect the documents together. Xerox Web Capture is the perfect solution for capturing your receipts and automatically importing them into your bookkeeping software.

Here is what you will need:

- If you have paper records and receipts, scan all of them using a secure printer and save them to a centralized cloud-based platform that is backed up regularly.

- If you have electronic records, receipts, and other tax documentation, print everything in case of an audit and be sure to do so securely. Xerox Web Capture works with most web applications, like Microsoft Office 365, QuickBooks, FreshBooks, Workday, and SAP.

- Ensure PDFs containing sensitive financial information (especially tax forms for employee and contractor wages) are password-protected.

-

If in doubt, hire an accountant.

Taxes are complicated. Even with the best resources and equipment on your side, all of those moving pieces can still be an overwhelming amount of “stuff” to handle. If you are struggling to wrap your head around what you need to do or nervous that you have missed something, don’t wait until it is too late. Consult with a tax specialist or accountant to help you. The peace of mind in knowing you are all squared away is probably worth the additional cost.

-

Start looking at next year.

Once you are in a proper headspace (i.e. you are about ready to file, or have already filed), take some time to assess what went well, what didn’t, and how you can improve for the next tax season. Trust me; it is never too early to get started on next year’s tax prep. Here are some suggestions:

- Open a business-only bank account and credit card (if you have not already).

- Review your current workspace and equipment. Are you getting the biggest bang for your buck? You may be able to consolidate equipment and maximize productivity by switching to a more efficient printer/scanner setup. If you’re looking for more ideas on how improve productivity to boost your bottom line, check out this survey report from Xerox.

- Keep better track of your costs. For starters, take a look at Xerox’s small office savings plan.

- Be sure to make major business purchases before the end of the year. That way you can write those off during the next tax season.

Don’t let tax season get you down. You have worked so hard all year long to support, build, and grow your business. Once you have nailed down a tax preparation process, tax filing will become easier with each passing year.

Ramon Ray, Marketing & Publisher of Smart Hustle Magazine and Small Business Evangelist, Infusionsoft. He frequently blogs about tech at SmallBizTechnology. Full bio at http://www.ramonray.com/. Visit his Small Business Solutions Blog Author Page to get in touch on Google+, Twitter or Facebook.

Share this article on Twitter! Tweet: 7 Things Small and Mid-Size Businesses Can Do to Beat the Stress of Tax Season https://ctt.ec/J3704+ via @XeroxOffice

Subscribe to the Small Business Solutions Blog and receive updates when we publish a new article. [wysija_form id=”1″]